Energy storage can make money right now. Finding the opportunities requires digging into real-world data.

Energy storage is a favorite technology of the future — for good reasons.

Many people see affordable storage as the missing link between intermittent renewable power, such as solar and wind, and 24/7 reliability. Utilities are intrigued by the potential for storage to meet other needs such as relieving congestion and smoothing out the variations in power that occur independent of renewable-energy generation. Major industrial companies consider storage a technology that could transform cars, turbines, and consumer electronics (see sidebar, “What is energy storage?”).

Others, however, take a dimmer view, believing that storage will not be economical any time soon. That pessimism cannot be dismissed. The transformative future of energy storage has been just around the corner for some time, and at the moment, storage constitutes a very small drop in a very large ocean.

This article does not consider pumped storage, the most common type of storage. It is used for hydro projects.

In 2015, a record 221 megawatts of storage capacity was installed in the United States,

Peter Maloney, « After record year, U.S. energy storage forecasted to break 1 GW capacity mark in 2019 »Utility Dive, March 7, 2016, utilitydive.com

more than three times as much as in 2014—65 megawatts, which was itself a big jump over the previous year. But more than 160 megawatts of the 2015 total was deployed by a single regional transmission organization, PJM Interconnection.

PJM serves all or part of Delaware; Illinois; Indiana; Kentucky; Maryland; Michigan; New Jersey; North Carolina; Ohio; Pennsylvania; Tennessee; Virginia; Washington, DC; and West Virginia.

And 221 megawatts is not much in the context of a total US generation capacity of more than a million megawatts.

Our research shows considerable near-term potential for stationary energy storage. One reason for this is that costs are falling and could be $200 per kilowatt-hour in 2020, half today’s price, and $160 per kilowatt-hour or less in 2025. Another is that identifying the most economical projects and highest-potential customers for storage has become a priority for a diverse set of companies including power providers, grid operators, battery manufacturers, energy-storage integrators, and businesses with established relationships with prospective customers such as solar developers and energy-service companies.

In this article, we describe how to find profitable possibilities for energy storage. We also highlight some policy limitations and how these might be addressed to accelerate market expansion. These insights could help forward-thinking companies win an early toehold in a market that in the United States could reach $2.5 billion by 2020—six times as much as in 2015.

The 2015 year-in-review executive summary,GTM Research, March 2016, greentechmedia.com.

The ultimate prize, of course, is much bigger. As the technology matures, we estimate that the global opportunity for storage could reach 1,000 gigawatts in the next 20 years.

Where to compete: Model insights

Identifying and prioritizing projects and customers is complicated. It means looking at how electricity is used and how much it costs, as well as the price of storage.

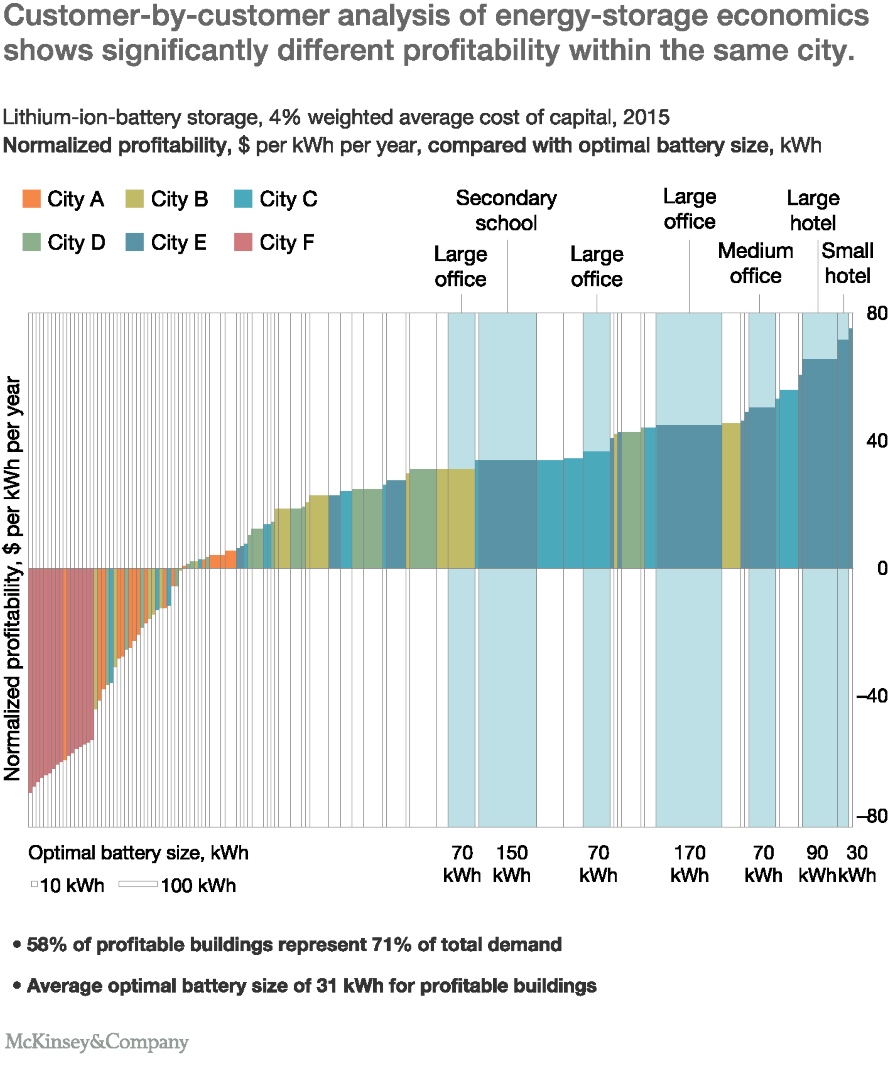

Too often, though, entities that have access to data on electricity use have an incomplete understanding of how to evaluate the economics of storage; those that understand these economics have limited access to real-world data on electricity use. Moreover, there has been a tendency to average the data when doing analyses. Aggregating numbers, however, is not useful when evaluating prospects for energy storage because identical buildings next door to each other could have entirely different patterns of electricity use. Conclusions drawn based on averages therefore do not have the precision needed to identify which customers would be profitable to serve.

In our research, we were able to access data from both utility and battery companies. On this basis, we found that it is quarter-hour-by-quarter-hour or even minute-by-minute use that reveals where the opportunities are.

To identify today’s desirable customers, we built a proprietary energy-storage-dispatch model that considers three kinds of real-world data:

- electricity production and consumption (“load profiles”), at intervals of seconds or minutes for at least a year

- battery characteristics, including price and performance

- electricity prices and tariffs

Using both public and private sources, we accessed data for more than a thousand different load profiles, dozens of batteries (including lithium ion, lead acid, sodium sulfur, and flow cell), and dozens of electricity tariff and pricing tables.

Our model, shown in the exhibit, identifies the size and type of energy storage needed to meet goals such as mitigating demand charges, providing frequency-regulation services, shifting or improving the control of renewable power at grid scale, and storing energy from residential solar installations.

Exhibit

The model shows that it is already profitable to provide energy-storage solutions to a subset of commercial customers in each of the four most important applications—demand-charge management, grid-scale renewable power, small-scale solar-plus storage, and frequency regulation.

Demand-charge management

Some customers are charged for using power during peak times (a practice known as a demand charge). Energy storage can be used to lower peak consumption (the highest amount of power a customer draws from the grid), thus reducing the amount customers pay for demand charges. Our model calculates that in North America, the break-even point for most customers paying a demand charge is about $9 per kilowatt. Based on our prior work looking at the reduction in costs of lithium-ion batteries, this could fall to $4 to $5 per kilowatt by 2020. Importantly, the profitability of serving prospective energy-storage customers even within the same geography and paying a similar tariff can vary by $90 per kilowatt of energy storage installed per year because of customer-specific behaviors. Another interesting insight from our model is that as storage costs fall, not only does it make economic sense to serve more customers, but the optimum size of energy storage increases for existing customers.

Grid-scale renewable power

Energy storage can smooth out or firm wind- and solar-farm output; that is, it can reduce the variability of power produced at a given moment. The incremental price for firming wind power can be as low as two to three cents per kilowatt-hour. Solar-power firming generally costs as much as ten cents per kilowatt-hour, because solar farms typically operate for fewer hours per day than wind farms.

Small-scale solar-plus storage

At a residential level, the combination of solar and storage is only worthwhile when specific market and regulatory conditions are in place to make the value of storage greater than the cost of installing it. This can happen, for example, when excess production can be stored for later consumption; in that case, consumers need to buy less power from the grid and thus cut their costs.

Frequency regulation

Electricity grids experience continuous imbalances between power generation and consumption because millions of devices are turned on and off in an uncorrelated way. These imbalances cause electricity frequencies to deviate, which can hurt sensitive equipment and, if left unchecked and allowed to become too large, even affect the stability of the grid. Storage systems are particularly well suited to frequency regulation because of their rapid response time and ability to charge and discharge efficiently.

Our model confirms that storage can be profitable in select frequency-regulation markets. The economics depend on the context. Ideally, batteries hover around a specific state of charge to minimize the amount of storage required.

Full article available at mckinsey.com

Article has been written by Paolo D’Aprile, John Newman, and Dickon Pinner from McKinsey&Company

by Alex Pisarev | février 7, 2017

by Alex Pisarev | février 7, 2017